US Mortgage Applications At 13 Year Low

US Mortgage Applications At 13 Year Low

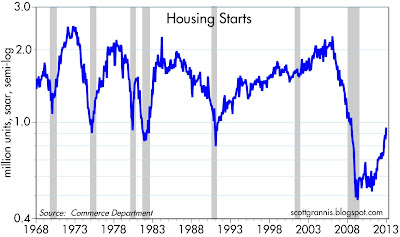

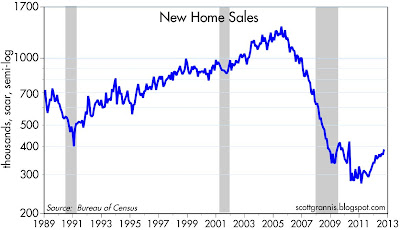

The good news is there still building lots of new houses in the US. The bad news is no one will be buying them.

US Mortgage Applications At 13 Year Low

http://www.zerohedge.com/news/2013-12-1 ... 3-year-low

US Mortgage Applications At 13 Year Low

http://www.zerohedge.com/news/2013-12-1 ... 3-year-low

Meet Loads of Foreign Women in Person! Join Our Happier Abroad ROMANCE TOURS to Many Overseas Countries!

Meet Foreign Women Now! Post your FREE profile on Happier Abroad Personals and start receiving messages from gorgeous Foreign Women today!

Re: US Mortgage Applications At 13 Year Low

Isn't that funny, I thought the housing market was supposed to be recovering, I guess not. Starting in January of 2014 it will be HARDER to get a mortgage in America because new laws go into effect regarding whether or not someone is eligible to buy a home.Taco wrote:The good news is there still building lots of new houses in the US. The bad news is no one will be buying them.

US Mortgage Applications At 13 Year Low

http://www.zerohedge.com/news/2013-12-1 ... 3-year-low

Check out this scary article, after these new laws go into effect in January of 2014, the housing market will really start to slow down!

http://www.businessweek.com/articles/20 ... the-market

"When I think about the idea of getting involved with an American woman, I don't know if I should laugh .............. or vomit!"

"Trying to meet women in America is like trying to decipher Egyptian hieroglyphics."

"Trying to meet women in America is like trying to decipher Egyptian hieroglyphics."

-

SilverEnergy

- Junior Poster

- Posts: 969

- Joined: July 7th, 2013, 2:41 pm

What does this mean for real estate investors?

It means that more apartments will be built and more people will be moving into apartment buildings!

But although this is happening, in places where the job and population are growing and the demand is high and the supply is low, people WILL be moving into homes and apartments.

To those interested in real estate, learn how to invest in apartment buildings.

It means that more apartments will be built and more people will be moving into apartment buildings!

But although this is happening, in places where the job and population are growing and the demand is high and the supply is low, people WILL be moving into homes and apartments.

To those interested in real estate, learn how to invest in apartment buildings.

"Allow me to show you the Power Cosmic!" - Silver Surfer

+1SilverEnergy wrote:What does this mean for real estate investors?

It means that more apartments will be built and more people will be moving into apartment buildings!

But although this is happening, in places where the job and population are growing and the demand is high and the supply is low, people WILL be moving into homes and apartments.

To those interested in real estate, learn how to invest in apartment buildings.

Multiunit housing in high demand areas is the way to go.

There is one complicating factor to all of this though. Nearly half of all homes are now bought with cash, an unprecedented number compared to years prior. It still isn't enough to make up for the crash in mortgage applications, but it makes things look a bit closer to where they should be.

http://www.marketwatch.com/story/nearly ... 2013-08-29

The number of new housing starts is absurd though, whoever is building these things is going to get burned pretty badly in the near future. I give it five years before a new housing crash. Anyone buying property for more than rental purposes is putting themselves out there for a world of hurt.

Actually it looks less bleak than I thought. A big reason sales are down is lack of inventory. That's why there is a lot of building going on. I still smell another housing bubble.

http://www.ibtimes.com/high-prices-low- ... er-1516330

http://www.ibtimes.com/high-prices-low- ... er-1516330

-

momopi

- Elite Upper Class Poster

- Posts: 4898

- Joined: August 31st, 2007, 9:44 pm

- Location: Orange County, California

Can't speak for other areas, but in Southern CA I invest in older SFR's along the I-15, and inventory today is very low. I brought a cash investor from Taiwan there this month and we could not find any SFR's for sale in my preferred neighborhoods. There were over-priced new builds elsewhere in the city, but we weren't interested in those.

Housing starts always spike due to anticipated sales, not due to current sales. A start has a completion time of 5-10 months, and as of the most recent data I can find from the SOC (it's a few months old, granted) only 6% of new homes were unsold at completion. They are building more because almost everything they build sells. We'll see how it looks in 10 months when all these homes are finished though, who knows. A lot will depend on what happens to interest rates and home prices during that time. It's also very market specific. A lot of existing homes are going unsold because they are in areas that took a beating during the recession and will never regain their value. There's whole suburbs that will likely never completely repopulate due to poverty and crime rates that have exploded after poor people flooded the foreclosure markets in them post-recession. So instead of selling homes in these existing suburbs, developers are just building new ones right on the edges of cities, with homes people want to live in and neighbors that are willing to pay a premium to not live in the "ghetto suburbs" that proliferated after the crash. The Houston area is a great example of this, where formerly good neighborhoods have become crime infested areas resembling many inner cities. Since there's plenty of land in Texas, people are just building new suburbs to replace the ones that have become slums. If you're ever driving through Houston and thinking to yourself, "Damn this place is huge," (Houston's city limits are half the size of Rhode Island) that is why.fschmidt wrote:Really?HouseMD wrote:Actually it looks less bleak than I thought. A big reason sales are down is lack of inventory. That's why there is a lot of building going on. I still smell another housing bubble.

http://www.progressivepress.net/are-the ... morphosis/

http://houston.culturemap.com/news/real ... new-homes/

http://eyeonhousing.org/2013/10/21/how- ... d-a-house/

http://www.bloomberg.com/news/2013-07-0 ... onomy.html

-

- Similar Topics

- Replies

- Views

- Last post

-

- 9 Replies

- 5364 Views

-

Last post by Winston

-

- 0 Replies

- 3775 Views

-

Last post by momopi

-

- 95 Replies

- 83230 Views

-

Last post by Lucas88

-

- 3 Replies

- 6733 Views

-

Last post by sherieshez

-

- 7 Replies

- 552 Views

-

Last post by WanderingProtagonist