Landlord Inc

-

Moretorque

- Elite Upper Class Poster

- Posts: 6288

- Joined: April 28th, 2013, 7:00 am

Meet Loads of Foreign Women in Person! Join Our Happier Abroad ROMANCE TOURS to Many Overseas Countries!

Meet Foreign Women Now! Post your FREE profile on Happier Abroad Personals and start receiving messages from gorgeous Foreign Women today!

-

momopi

- Elite Upper Class Poster

- Posts: 4898

- Joined: August 31st, 2007, 9:44 pm

- Location: Orange County, California

Really? In 1950 the average new built SFR was 983 sq ft. In 2007 the average new built SFR is 2,320 sq ft. You don't think the 236% increase in size has anything to do with the increase in home prices?Moretorque wrote: You are full of it, the whole game is rigged by the Fed. I suggest you go educate yourself about what the FED is doing at this very moment in order to re inflate the whole housing and property sector and at the same time taking all the drivers out of the economy so paying your mortgage back will be nearly impossible for future generations.

Does "rigging" by the Feds account for the additional costs in lumber, foundation, piping, tiles, windows, roof, fixtures, bathrooms, etc. ?

Moretorque wrote:I object to the whole thing, people need to own their homes outright and have a solid foundation to live and build a family if desired.

Does everyone here understand the concept of buying a SMALLER and more AFFORDABLE home, so that you can pay it off sooner?momopi wrote: Nobody forced you to buy a house and nobody forced you buy a house with 30 year loan. It's your choice to buy a cheaper home with 15 or even 10 year mortgage, and make additional payments toward your principal. Very few mortgages have prepayment penalties today. I've known a number of people who chose smaller/cheaper homes with 15 year loans, have it paid off and retired early.

-

Moretorque

- Elite Upper Class Poster

- Posts: 6288

- Joined: April 28th, 2013, 7:00 am

The process of building a house is so much more efficient today { like everything else} to the point to where you walk up to a wall and punch your fist through it like a piece of cardboard, I live in a house made in 1929, come punch one of my walls and you will break your fuc king hand.momopi wrote:Really? In 1950 the average new built SFR was 983 sq ft. In 2007 the average new built SFR is 2,320 sq ft. You don't think the 236% increase in size has anything to do with the increase in home prices?Moretorque wrote: You are full of it, the whole game is rigged by the Fed. I suggest you go educate yourself about what the FED is doing at this very moment in order to re inflate the whole housing and property sector and at the same time taking all the drivers out of the economy so paying your mortgage back will be nearly impossible for future generations.

Does "rigging" by the Feds account for the additional costs in lumber, foundation, piping, tiles, windows, roof, fixtures, bathrooms, etc. ?

Moretorque wrote:I object to the whole thing, people need to own their homes outright and have a solid foundation to live and build a family if desired.Does everyone here understand the concept of buying a SMALLER and more AFFORDABLE home, so that you can pay it off sooner?momopi wrote: Nobody forced you to buy a house and nobody forced you buy a house with 30 year loan. It's your choice to buy a cheaper home with 15 or even 10 year mortgage, and make additional payments toward your principal. Very few mortgages have prepayment penalties today. I've known a number of people who chose smaller/cheaper homes with 15 year loans, have it paid off and retired early.

Why do prices keep going up and up when everything is so much easier to make today because how much more efficient the industrial process has come, this be one stupid mother fuc ker. 20 years!

Time to Hide!

Not everyone is getting a high whorporate salary and then impoverishing themself by blowing it on self-indulgent crap, you know. Most people are being impoverished automatically. The McMansion trend is a minor factor in housing cost increase in most places. When my older brothers went to Uni in the 80s, renting a room in a house close to the campus cost ~$10. By the time I was there in the 90s, renting the same room cost ~$60 and now it would cost ~$140. Sure there has been some increase in wages and welfare over the same period, but nowhere near as much. I don't see why there is this resistance to admitting the obvious truth that people are being screwed worse and worse by the banksters as time goes on.momopi wrote:Really? In 1950 the average new built SFR was 983 sq ft. In 2007 the average new built SFR is 2,320 sq ft. You don't think the 236% increase in size has anything to do with the increase in home prices?Moretorque wrote: You are full of it, the whole game is rigged by the Fed. I suggest you go educate yourself about what the FED is doing at this very moment in order to re inflate the whole housing and property sector and at the same time taking all the drivers out of the economy so paying your mortgage back will be nearly impossible for future generations.

Does "rigging" by the Feds account for the additional costs in lumber, foundation, piping, tiles, windows, roof, fixtures, bathrooms, etc. ?

Moretorque wrote:I object to the whole thing, people need to own their homes outright and have a solid foundation to live and build a family if desired.Does everyone here understand the concept of buying a SMALLER and more AFFORDABLE home, so that you can pay it off sooner?momopi wrote: Nobody forced you to buy a house and nobody forced you buy a house with 30 year loan. It's your choice to buy a cheaper home with 15 or even 10 year mortgage, and make additional payments toward your principal. Very few mortgages have prepayment penalties today. I've known a number of people who chose smaller/cheaper homes with 15 year loans, have it paid off and retired early.

-

momopi

- Elite Upper Class Poster

- Posts: 4898

- Joined: August 31st, 2007, 9:44 pm

- Location: Orange County, California

1929:Moretorque wrote: The process of building a house is so much more efficient today { like everything else} to the point to where you walk up to a wall and punch your fist through it like a piece of cardboard, I live in a house made in 1929, come punch one of my walls and you will break your fuc king hand.

Why do prices keep going up and up when everything is so much easier to make today because how much more efficient the industrial process has come, this be one stupid mother fuc ker. 20 years!

2012:

2012, MacMansion:

?_? Where did you guys rent rooms for $10-$60/month? In 1983, we paid $500/month to rent a small 2 bed condo in Lakewood, and that was a "cheap" rental.Cornfed wrote:Not everyone is getting a high whorporate salary and then impoverishing themself by blowing it on self-indulgent crap, you know. Most people are being impoverished automatically. The McMansion trend is a minor factor in housing cost increase in most places. When my older brothers went to Uni in the 80s, renting a room in a house close to the campus cost ~$10. By the time I was there in the 90s, renting the same room cost ~$60 and now it would cost ~$140. Sure there has been some increase in wages and welfare over the same period, but nowhere near as much. I don't see why there is this resistance to admitting the obvious truth that people are being screwed worse and worse by the banksters as time goes on.

-

Moretorque

- Elite Upper Class Poster

- Posts: 6288

- Joined: April 28th, 2013, 7:00 am

momopi wrote:1929:Moretorque wrote: The process of building a house is so much more efficient today { like everything else} to the point to where you walk up to a wall and punch your fist through it like a piece of cardboard, I live in a house made in 1929, come punch one of my walls and you will break your fuc king hand.

Why do prices keep going up and up when everything is so much easier to make today because how much more efficient the industrial process has come, this be one stupid mother fuc ker. 20 years!

2012:

2012, MacMansion:

?_? Where did you guys rent rooms for $10-$60/month? In 1983, we paid $500/month to rent a small 2 bed condo in Lakewood, and that was a "cheap" rental.Cornfed wrote:Not everyone is getting a high whorporate salary and then impoverishing themself by blowing it on self-indulgent crap, you know. Most people are being impoverished automatically. The McMansion trend is a minor factor in housing cost increase in most places. When my older brothers went to Uni in the 80s, renting a room in a house close to the campus cost ~$10. By the time I was there in the 90s, renting the same room cost ~$60 and now it would cost ~$140. Sure there has been some increase in wages and welfare over the same period, but nowhere near as much. I don't see why there is this resistance to admitting the obvious truth that people are being screwed worse and worse by the banksters as time goes on.

Dude your full of crap, the housing market has been so inflated with this counterfeiting con job it is ridiculous. The house I live in now will be solidly here in 2139 and the new 3000 sq foot cardboard box they call a house of today will probably collapse before the mortgage on it is paid off.

Time to Hide!

-

fschmidt

- Elite Upper Class Poster

- Posts: 3479

- Joined: May 18th, 2008, 1:16 am

- Location: El Paso, TX

- Contact:

In case anyone is interested, here is the prospectus for AMH:

http://www.sec.gov/Archives/edgar/data/ ... d424b4.htm

http://www.sec.gov/Archives/edgar/data/ ... d424b4.htm

-

Moretorque

- Elite Upper Class Poster

- Posts: 6288

- Joined: April 28th, 2013, 7:00 am

And what you are going top find is all controlling stocks in these corps will go back to the credit monopoly, as Cornfed posted the whole system is designed to where the old elite who set this money con up end up controlling all in the end.fschmidt wrote:In case anyone is interested, here is the prospectus for AMH:

http://www.sec.gov/Archives/edgar/data/ ... d424b4.htm

Go read the tenancy plan for us serfs in the communist manifesto.

Time to Hide!

-

momopi

- Elite Upper Class Poster

- Posts: 4898

- Joined: August 31st, 2007, 9:44 pm

- Location: Orange County, California

Moretorque wrote: Dude your full of crap, the housing market has been so inflated with this counterfeiting con job it is ridiculous. The house I live in now will be solidly here in 2139 and the new 3000 sq foot cardboard box they call a house of today will probably collapse before the mortgage on it is paid off.

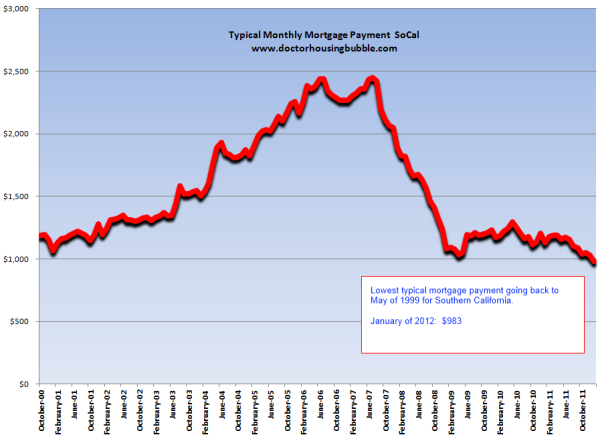

I live in Southern CA, probably one of the worst hit areas of the housing boom and bust cycles. At the peak of the recent housing bubble, a typical new mortgage payment was $2,447/month. In 2012 it declined to $983/month, a 59% drop. When it's cheaper to buy than to rent, cash-flow investors like myself start buying.

If you think housing market is "so inflated", I'd challenge that and say the investment value of a property is tied to its potential rental income. When it's cheaper to buy than to rent, the house is under-valued. When it's cheaper to rent than to buy, the home is over-valued. There are exceptions, such as premiums and Chinese EB5 investors. i.e. Canadian buyers of CA RE purchase homes with median price of $183K, versus Chinese buyers purchase homes with median price of $425K, with 80% of EB5 applicants being Chinese nationals. Since what they really want is a green card, return on investment for them differs from us.

I put my money where my mouth is. If I'm right, I will continue to make a profit and enjoy a comfortable living. If I'm wrong, then my investments collapse. It's that simple.

-

Moretorque

- Elite Upper Class Poster

- Posts: 6288

- Joined: April 28th, 2013, 7:00 am

momopi wrote:Moretorque wrote: Dude your full of crap, the housing market has been so inflated with this counterfeiting con job it is ridiculous. The house I live in now will be solidly here in 2139 and the new 3000 sq foot cardboard box they call a house of today will probably collapse before the mortgage on it is paid off.

I live in Southern CA, probably one of the worst hit areas of the housing boom and bust cycles. At the peak of the recent housing bubble, a typical new mortgage payment was $2,447/month. In 2012 it declined to $983/month, a 59% drop. When it's cheaper to buy than to rent, cash-flow investors like myself start buying.

If you think housing market is "so inflated", I'd challenge that and say the investment value of a property is tied to its potential rental income. When it's cheaper to buy than to rent, the house is under-valued. When it's cheaper to rent than to buy, the home is over-valued. There are exceptions, such as premiums and Chinese EB5 investors. i.e. Canadian buyers of CA RE purchase homes with median price of $183K, versus Chinese buyers purchase homes with median price of $425K, with 80% of EB5 applicants being Chinese nationals. Since what they really want is a green card, return on investment for them differs from us.

I put my money where my mouth is. If I'm right, I will continue to make a profit and enjoy a comfortable living. If I'm wrong, then my investments collapse. It's that simple.

First off a $ is specified in the 1792 coinage act, excuse me the market is not inflated in real terms the money is going to it's real value 0. Well it's all up to the credit monopoly, what do you think they will do next? because if you have not figured it out yet the whole game is rigged and those worthless slugs in your pockets are not dollars! an obligation to be paid back + interest.

Your home is supposed to be your sanctuary to get away from it all, Thomas Jefferson said if you allow the banks to issue the currency our children will end up homeless. Knock yourself out playing the con game.

Time to Hide!

-

momopi

- Elite Upper Class Poster

- Posts: 4898

- Joined: August 31st, 2007, 9:44 pm

- Location: Orange County, California

Please tell us how YOU plan to deal with the "con game".Moretorque wrote: First off a $ is specified in the 1792 coinage act, excuse me the market is not inflated in real terms the money is going to it's real value 0. Well it's all up to the credit monopoly, what do you think they will do next? because if you have not figured it out yet the whole game is rigged and those worthless slugs in your pockets are not dollars! an obligation to be paid back + interest.

Your home is supposed to be your sanctuary to get away from it all, Thomas Jefferson said if you allow the banks to issue the currency our children will end up homeless. Knock yourself out playing the con game.

-

Moretorque

- Elite Upper Class Poster

- Posts: 6288

- Joined: April 28th, 2013, 7:00 am

I'm not going to deal with it in any fashion, the information is out there and Daa herd be taking an IQ test. The majority rule and if Daa herd be dis stupid than let the creditors have it.momopi wrote:Please tell us how YOU plan to deal with the "con game".Moretorque wrote: First off a $ is specified in the 1792 coinage act, excuse me the market is not inflated in real terms the money is going to it's real value 0. Well it's all up to the credit monopoly, what do you think they will do next? because if you have not figured it out yet the whole game is rigged and those worthless slugs in your pockets are not dollars! an obligation to be paid back + interest.

Your home is supposed to be your sanctuary to get away from it all, Thomas Jefferson said if you allow the banks to issue the currency our children will end up homeless. Knock yourself out playing the con game.

Time to Hide!

-

Moretorque

- Elite Upper Class Poster

- Posts: 6288

- Joined: April 28th, 2013, 7:00 am

I'd much rather do nothing than play their con game, and definitely the joke is on us.momopi wrote:So, in other words, you do... nothing?Moretorque wrote: I'm not going to deal with it in any fashion, the information is out there and Daa herd be taking an IQ test. The majority rule and if Daa herd be dis stupid than let the creditors have it.

Time to Hide!

-

fschmidt

- Elite Upper Class Poster

- Posts: 3479

- Joined: May 18th, 2008, 1:16 am

- Location: El Paso, TX

- Contact:

Their average rent is $16,284 at a 97% occupancy rate. Their average cost of buying and fixing up a property is $173,327. So their cap rate is:fschmidt wrote:In case anyone is interested, here is the prospectus for AMH:

http://www.sec.gov/Archives/edgar/data/ ... d424b4.htm

0.97 * 16,284 / 173,327 = 0.09

A 9% cap rate is quite good.

I am somewhat concerned about their structure, in particular, I don't understand the role of American Homes 4 Rent, LLC. And I am especially concerned about "Advisory fees" on their cash flow statement. It is explained but I don't understand the explanation and I can't tell if this will go away or not. This is critical because this would eat up most of the profit. I hope their earnings release on Tuesday clears this up.

If they were a simple REIT with a 9% cap rate selling at close to book value, I think that would be a great buy. I just need to clear up the issues I mentioned.

-

- Similar Topics

- Replies

- Views

- Last post

-

- 6 Replies

- 3410 Views

-

Last post by The_Adventurer